Introduction

Are you a government employee curious about how your salary might change with the 8th Pay Commission Salary Calculator? You’re not alone. Millions of employees eagerly wait for these pay revisions, as they directly impact salaries, pensions, and allowances. Think of it like upgrading from a basic mobile phone to a smartphone—suddenly, your financial life feels a lot more manageable.

Table of Contents

What is the 8th Pay Commission?

The 8th Pay Commission is one of the most-awaited financial reforms for government employees in India. Set to revise the salaries, pensions, and allowances of nearly 50 lakh central government employees and over 65 lakh pensioners, this commission plays a vital role in improving financial stability.

As per trends, each Pay Commission comes into effect every 10 years. The 7th Pay Commission was implemented in 2016, and now the 8th Pay Commission is expected around 2026, with discussions already heating up among employees and policymakers.

With the growing anticipation, an 8th Pay Commission Salary Calculator has become an essential tool to estimate revised salaries, pensions, and other benefits.

What is the 8th Pay Commission Salary Calculator?

The 8th Pay Commission Salary Calculator is an online tool designed to help employees and pensioners calculate their expected salaries under the new pay structure. By simply entering current pay details, employees can get an accurate estimation of their revised salaries based on the fitment factor, DA, HRA, and other allowances.

This tool eliminates confusion and provides transparency about the salary structure, ensuring employees can plan their finances effectively.

Why Do You Need the Salary Calculator?

Accurate Salary Estimation

Government pay structures are complicated, with multiple pay levels, bands, and allowances. The calculator provides instant, accurate salary projections based on expected changes in the 8th CPC.

Helps in Financial Planning

Clarity on revised salaries helps employees prepare for loans, savings, and investments. For instance, knowing your expected pay hike helps in home loan eligibility and retirement planning.

Transparent Salary Structure

The tool shows a clear breakdown of salary components like Basic Pay, DA, and HRA, helping employees understand exactly where the hike is coming from.

Expected Salary Hike in the 8th Pay Commission

One of the biggest reasons employees eagerly await the commission is the salary hike.

Fitment Factor Impact

The fitment factor—a multiplier applied to basic pay—determines how much salaries increase.

- In the 7th Pay Commission, it was 2.57.

- In the 8th Pay Commission, experts predict it could rise to 3.68.

Example: An employee with a basic pay of ₹25,000 could see it revised to ₹92,000+.

Basic Pay Revision

The minimum basic pay is likely to increase from ₹18,000 (7th CPC) to at least ₹26,000 or higher.

Allowances and Perks

Not just basic salary, allowances like DA, HRA, TA, and medical benefits are also expected to rise significantly, leading to an overall hike of 30–35% in salaries.

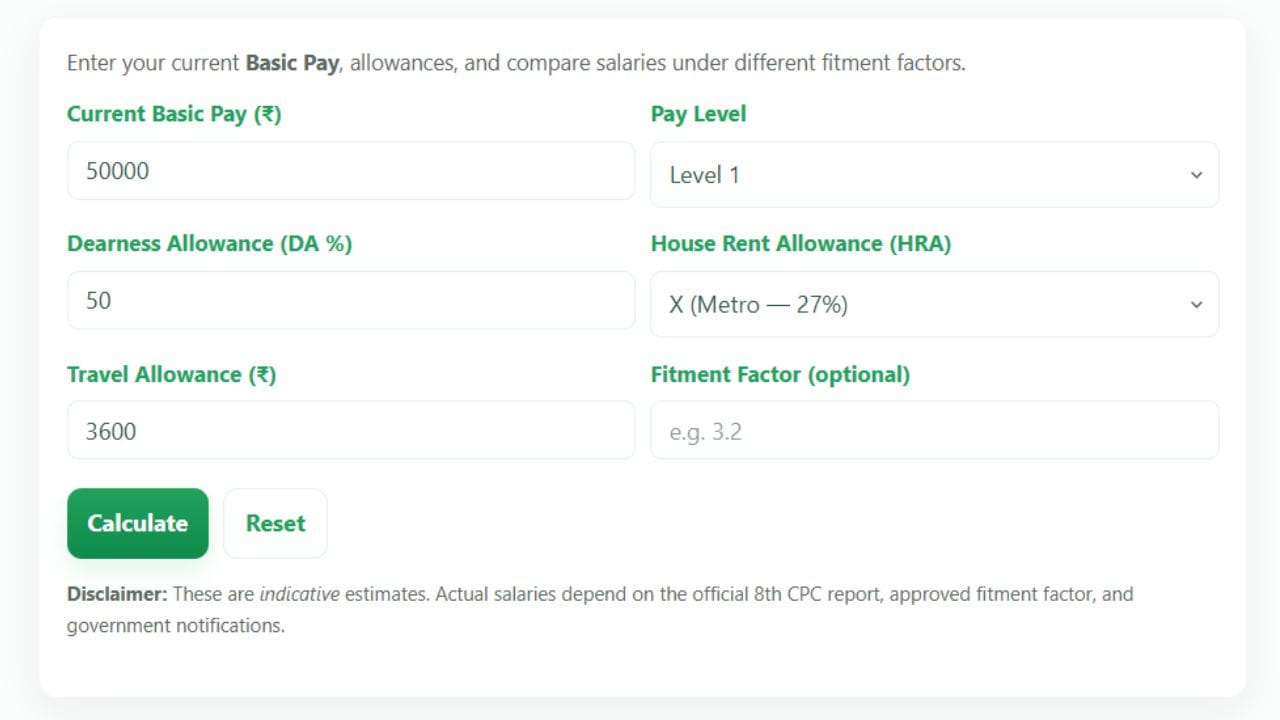

How to Use the 8th Pay Commission Salary Calculator

Using the calculator is simple and requires only a few details.

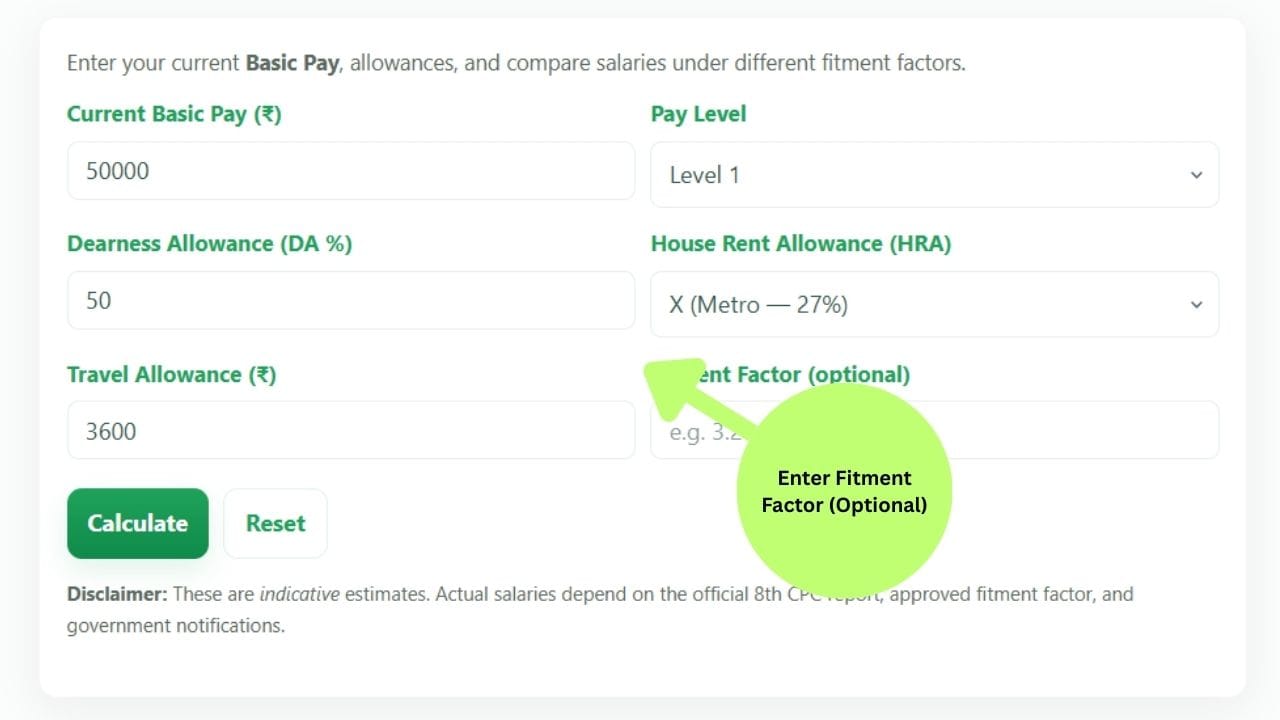

Step-by-Step Guide

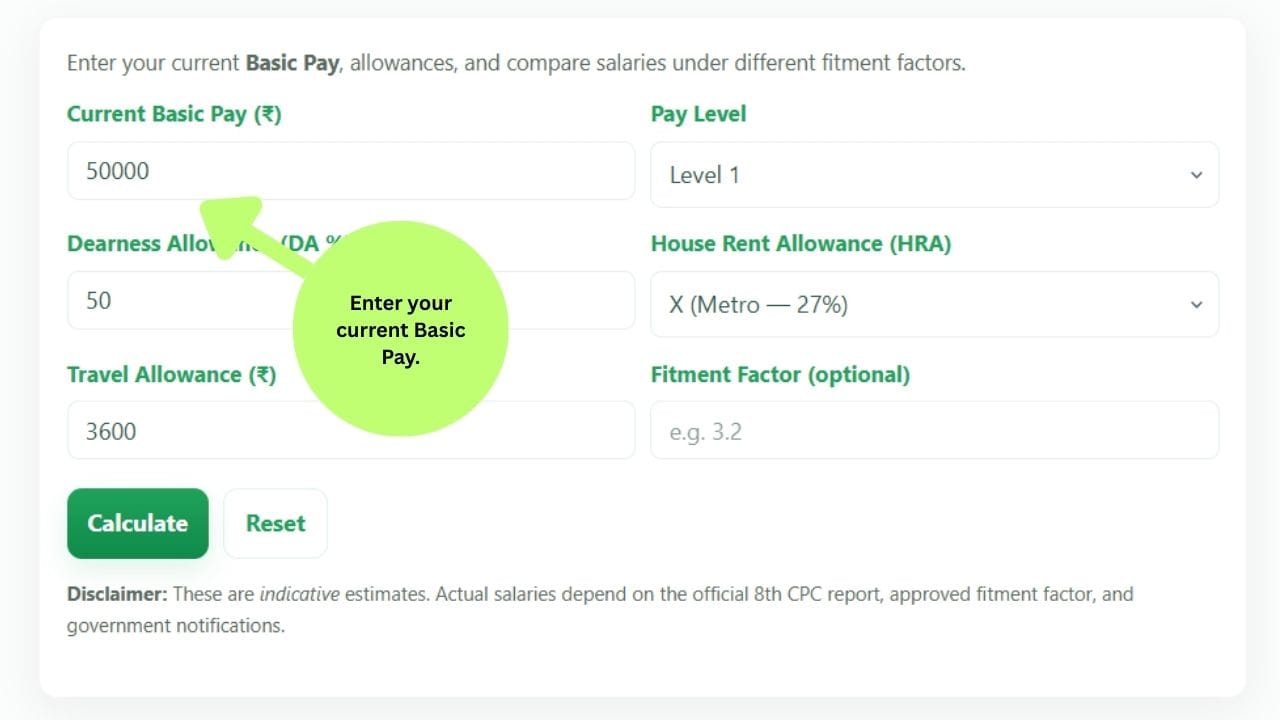

- Enter your current Basic Pay.

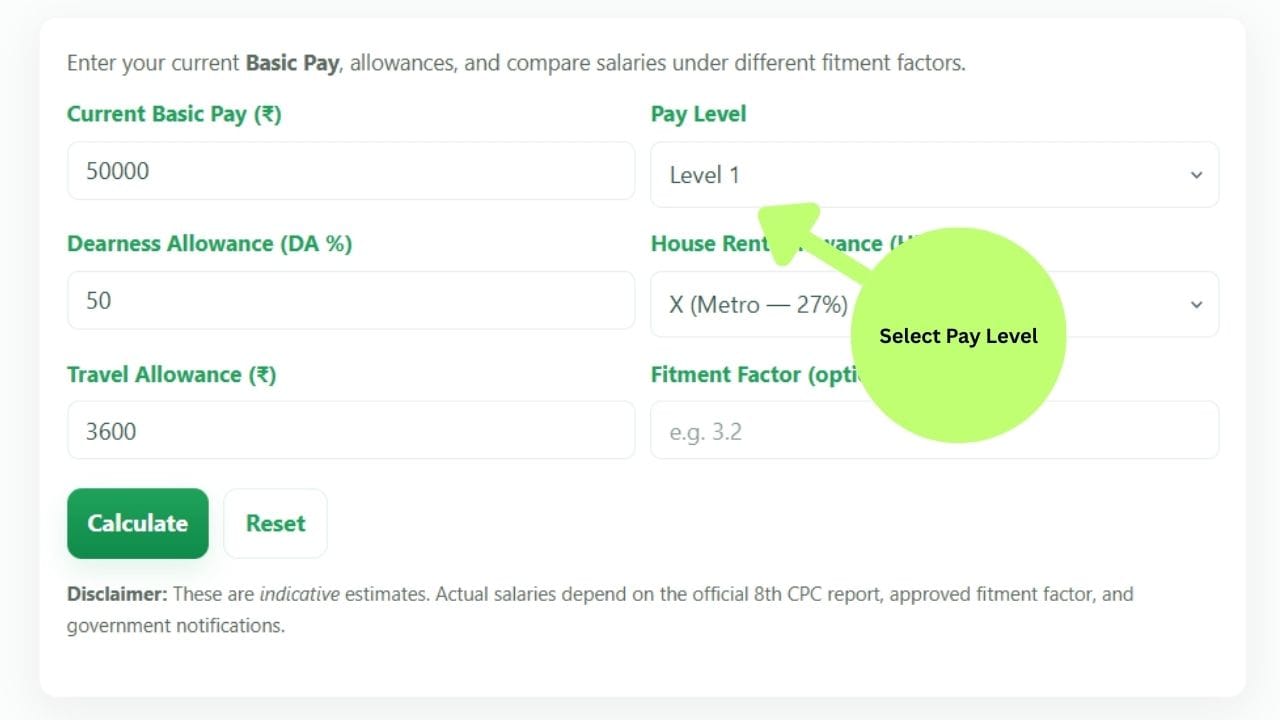

- Select your Pay Matrix Level.

- Enter allowances like DA, HRA, and TA.

- Enter Fitment Factor (optional).

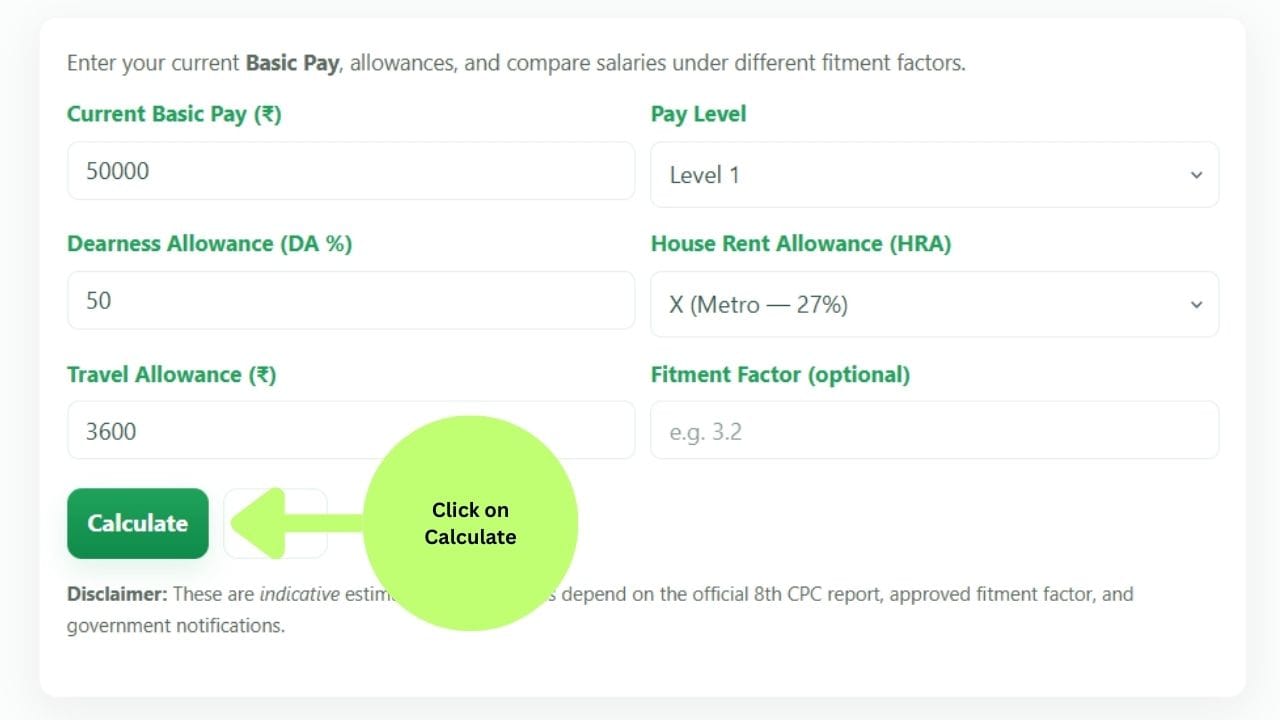

- Click on Calculate.

- Instantly view your expected revised salary.

Input Parameters Required

- Current Basic Pay

- Pay Level (from 1 to 18)

- Allowances (DA, HRA, TA, Medical)

- Projected fitment factor

Example Calculation

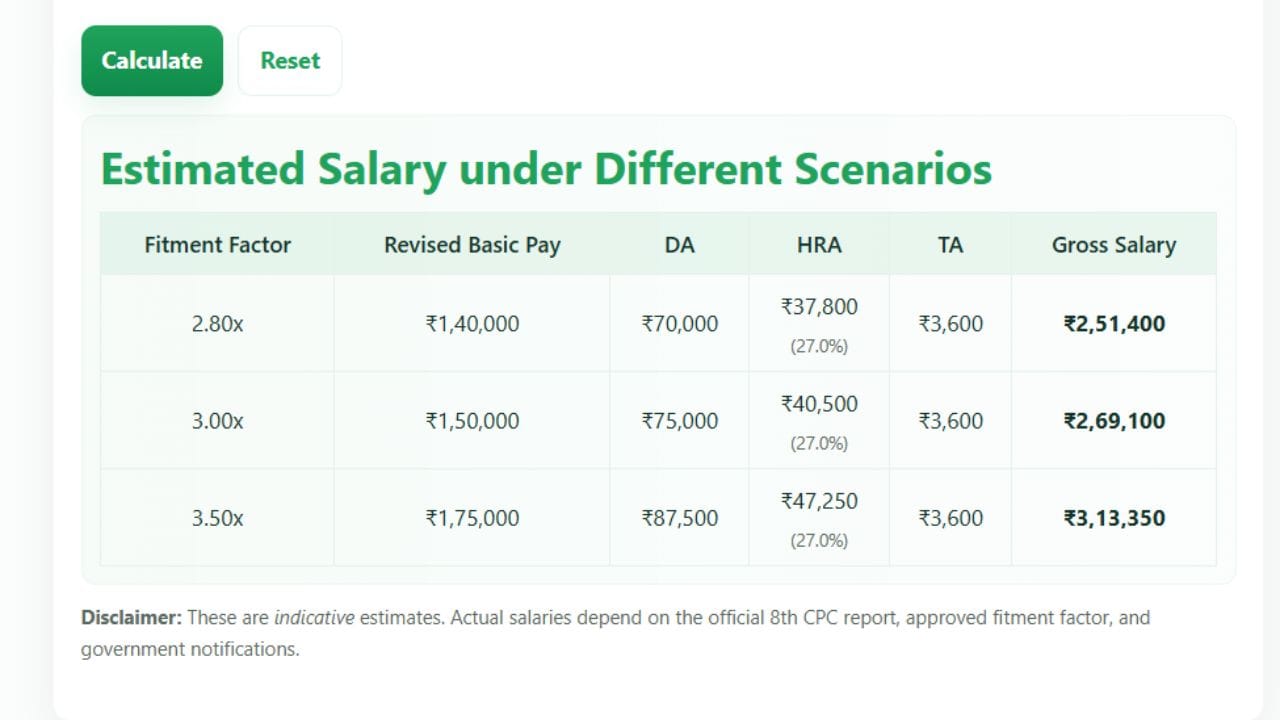

Suppose an employee’s Basic Pay is ₹30,000:

- Applying fitment factor of 3.68 → ₹1,10,400 (new Basic Pay)

- Adding DA (50%) → ₹55,200

- Adding HRA (24%) → ₹26,496

- Final salary = ₹1,91,000+ per month

Formula for the 8th Pay Commission Salary Calculator

New Basic Pay = Current Basic Pay × Fitment Factor

New Salary = New Basic Pay + DA + HRA + TA

8th Pay Commission vs 7th Pay Commission

| Feature | 7th Pay Commission | 8th Pay Commission (Expected) |

|---|---|---|

| Implementation Year | 2016 | 2026 (expected) |

| Minimum Basic Pay | ₹18,000 | ₹26,000–₹27,000 |

| Fitment Factor | 2.57 | 3.68 |

| Salary Hike | 14–16% | 30–35% |

| DA Calculation | 2 times yearly | Likely quarterly revision |

| Pension Benefits | Linked to basic pay | Higher due to revised pay |

This comparison shows how the 8th CPC could bring stronger financial relief for employees compared to the 7th CPC.

Allowances Covered in the Salary Calculator

Dearness Allowance (DA)

DA helps offset inflation. It is usually revised twice a year and will continue to be a major part of the new pay structure.

House Rent Allowance (HRA)

Employees in metro cities get higher HRA (24% of Basic Pay). With a higher basic salary, HRA will also rise.

Travel and Medical Allowances

Travel Allowance (TA) and Medical benefits are included, ensuring employees are supported for daily travel and healthcare needs.

Benefits of the 8th Pay Commission Salary Calculator

User-Friendly Interface

Most calculators are easy to use, requiring just a few inputs.

Instant Results

Employees don’t have to manually calculate salaries with complicated formulas—the tool does it instantly.

Helps in Loan & Investment Planning

Banks and financial institutions often consider revised salaries when approving loans. The calculator helps employees plan accordingly.

Who Can Use the 8th Pay Commission Salary Calculator?

Central Government Employees

All levels of central government employees can use it.

State Government Employees

Although pay commissions are for central employees, many states adopt similar pay scales.

Pensioners and Retired Employees

Pensioners can also estimate their revised pensions, since pensions are linked to revised basic pay.

Step-by-Step Example of Salary Calculation

Sample Case Study

Employee: Pay Level 7, Basic Pay = ₹44,900

- Fitment Factor (3.68) = ₹1,65,232

- DA (50%) = ₹82,616

- HRA (24%) = ₹39,655

- TA & Medical = ₹10,000 (approx.)

Estimated Salary = ₹2,97,500 per month

Pay Band Explanation

Pay levels will remain the same (1–18), but salaries within each band will increase sharply.

Net Take-Home Pay

After deductions like PF, NPS, and tax, employees may take home around 80–85% of the revised gross salary.

Common Myths About the 8th Pay Commission

- Myth: It guarantees double salaries.

- Reality: Increases depend on the fitment factor and government approval.

- Myth: Only central employees benefit.

- Reality: Many state governments also adopt pay commission recommendations.

Latest Updates on 8th Pay Commission 2025

- Date of Implementation: Expected from January 1, 2026.

- Fitment Factor Recommendations: Likely to be 3.68, bringing a major salary jump.

- Employees’ Expectations: Staff associations are demanding a minimum basic pay of ₹27,000–₹30,000.

For the latest updates, you can also follow the official Ministry of Finance Notifications.

Frequently Asked Questions (FAQ) – 8th Pay Commission Salary Calculator

1. When will the 8th Pay Commission be implemented?

The exact date isn’t confirmed yet, but it’s expected around 2026.

2. What is the projected fitment factor?

Experts suggest it may increase from 2.57 (7th CPC) to around 3.68 (8th CPC).

3. Can pensioners use the salary calculator?

Yes, pensioners can estimate their revised pensions as pensions are linked to revised basic pay.

4. How much minimum basic pay is expected?

The minimum pay is expected to rise from ₹18,000 to around ₹26,000–₹27,000.

5. Will allowances also increase?

Yes, allowances like DA, HRA, TA, and medical benefits will all increase proportionally.

6. Where can I check official updates?

On the official Ministry of Finance website or notifications published in The Gazette of India.

Conclusion

The 8th Pay Commission Salary Calculator is more than just a tool—it’s a financial planning companion for millions of government employees and pensioners. With expected hikes of 30–35%, increased allowances, and higher pensions, the upcoming pay commission could significantly boost the living standards of employees.

Whether you’re planning for a loan, retirement, or just curious about your future earnings, using the calculator ensures transparency and clarity. As we approach 2026, staying updated with official announcements will be key.

8th Pay Commission Salary Calculator

Free online calculator for Indian government employees to estimate salary, allowances, and benefits under the 8th Pay Commission with ease and accuracy.

Price Currency: INR

Operating System: web

Application Category: Calculator

5