Have you ever wondered how much money you’ll get as a gratuity after years of loyal service in a company? Many employees often hear about gratuity but don’t fully understand what it is or how it is calculated. That’s where a Gratuity Calculator comes in handy.

Think of gratuity as a “thank you gift” your employer gives you for staying loyal to their company. But, like any gift, the amount depends on certain conditions—such as how long you’ve worked and your last drawn salary.

Table of Contents

What is Gratuity?

Gratuity is a lump-sum payment made by an employer to an employee as a token of appreciation for their long-term service. It is governed by the Payment of Gratuity Act, 1972, in India.

In simple terms, gratuity is like a farewell bonus for your years of dedication to a company.

Importance of Gratuity for Employees

Why should you care about gratuity?

- It acts as a financial cushion when you retire or leave a job.

- It rewards your loyalty and long service.

- It encourages employees to stay longer with the company.

Think of gratuity as a piggy bank that grows quietly in the background while you continue working.

Who is Eligible for Gratuity?

Not every employee automatically qualifies. To be eligible:

- You must have worked for at least 5 years continuously in the same organization.

- Gratuity is payable at the time of retirement, resignation, or termination.

- In case of death or disability, gratuity is paid regardless of service length.

How is Gratuity Calculated?

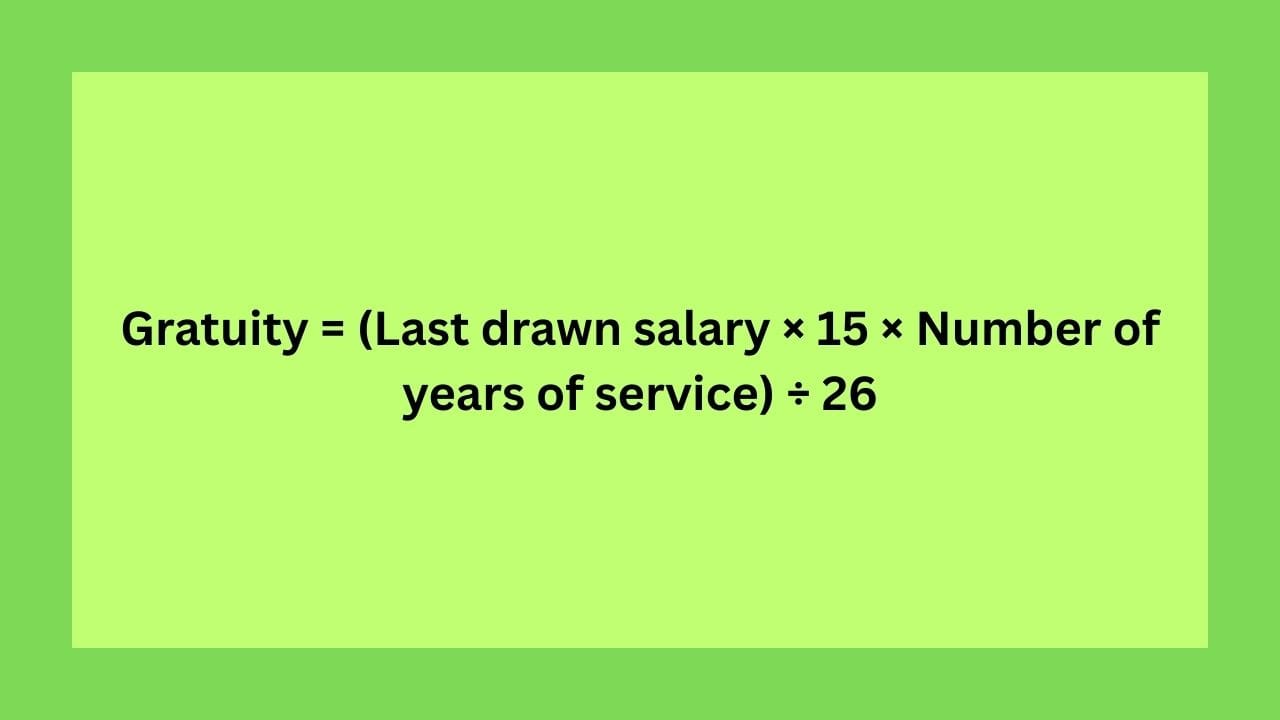

The gratuity calculation formula under the Payment of Gratuity Act, 1972, is:

Gratuity = (Last Drawn Basic Salary + Dearness Allowance) × 15 × Completed Years of Service ÷ 26

Where:

- Last Drawn Salary → Only Basic Salary + Dearness Allowance (DA) are considered (HRA, bonuses, and other allowances are excluded).

- 15 → Represents 15 days of wages for every year of service.

- 26 → Average number of working days in a month.

Example:

If your last drawn Basic + DA = ₹30,000, and you worked for 10 years:

Gratuity = (30,000 × 15 × 10) ÷ 26 = ₹1,73,077

Formula for Gratuity Calculation

For employees covered under the Gratuity Act, the formula is:

Gratuity = (Last drawn salary × 15 × Number of years of service) ÷ 26

- Here, 26 represents the number of working days in a month (excluding Sundays).

- If you’ve worked for more than 6 months in a year, it is rounded up to the next year.

What is a Gratuity Calculator?

Gratuity is a monetary benefit provided by an employer to an employee as a token of appreciation for dedicated service. It becomes payable when an employee:

- Resigns after at least 5 years of continuous service

- Retires or superannuates

- Becomes disabled due to an accident or illness

- In the unfortunate event of death, gratuity is payable to the nominee, even if the employee has not completed 5 years.

In short, gratuity serves as a retirement benefit that ensures financial security for employees after leaving an organization.

Benefits of Using a Gratuity Calculator

- Saves time: No manual calculations.

- Accurate results: No risk of mistakes in formulas.

- Easy to use: Just fill in basic details.

- Helps in planning: Know how much you will receive and plan your finances accordingly.

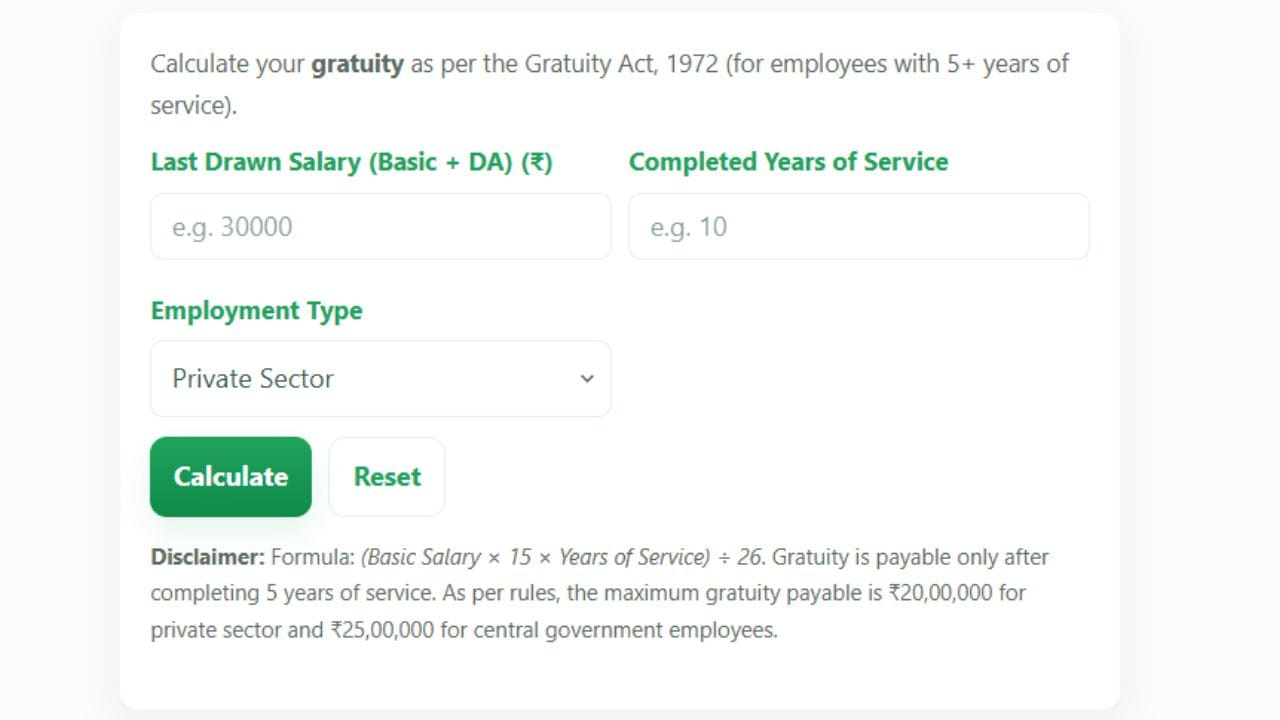

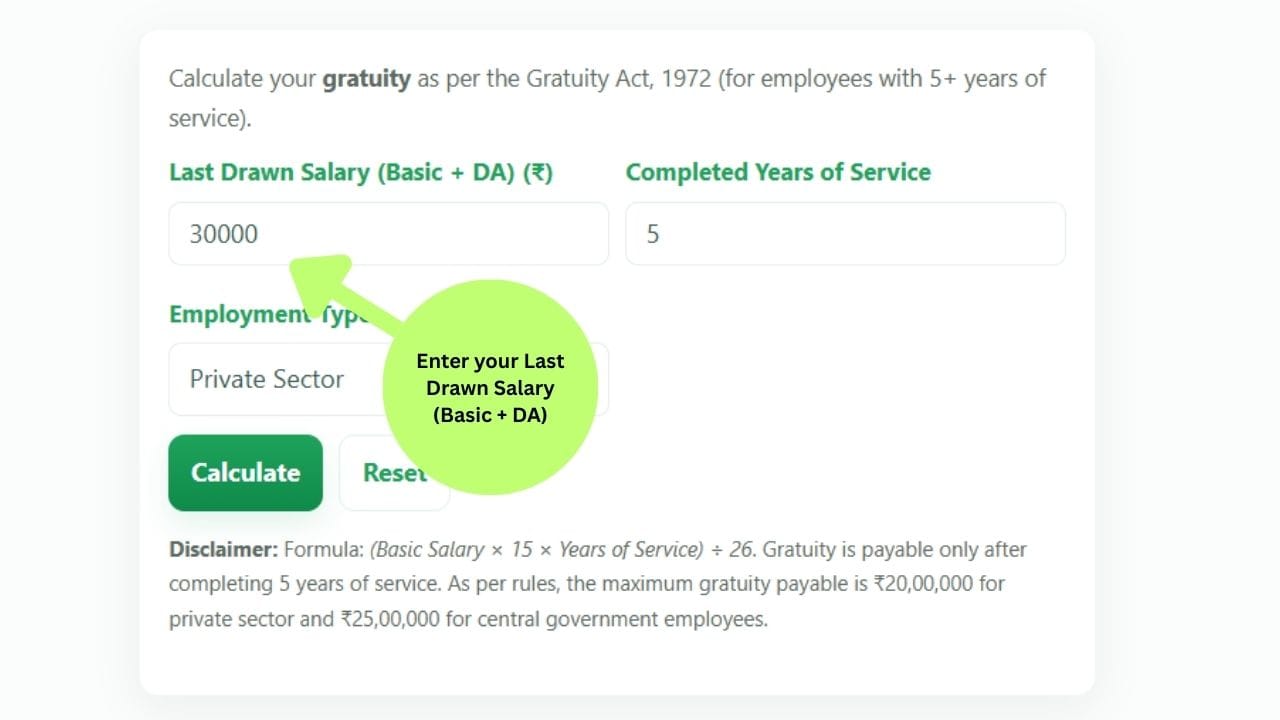

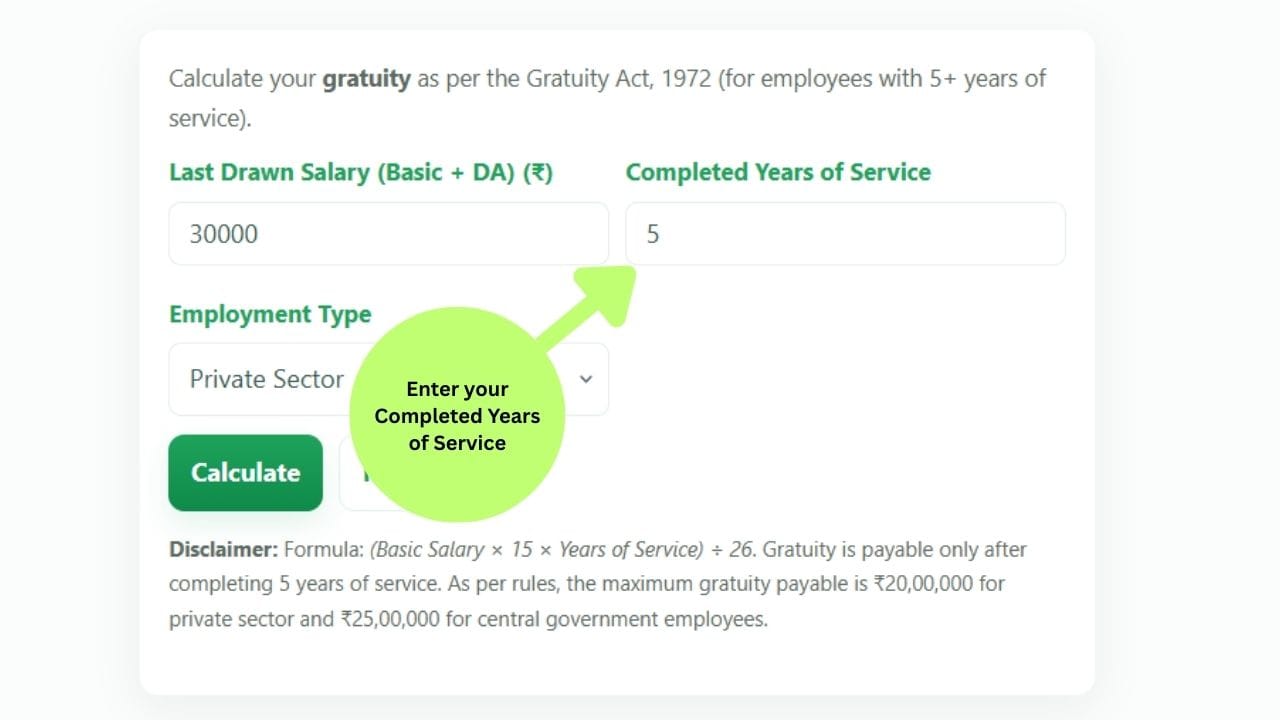

Online Gratuity Calculator

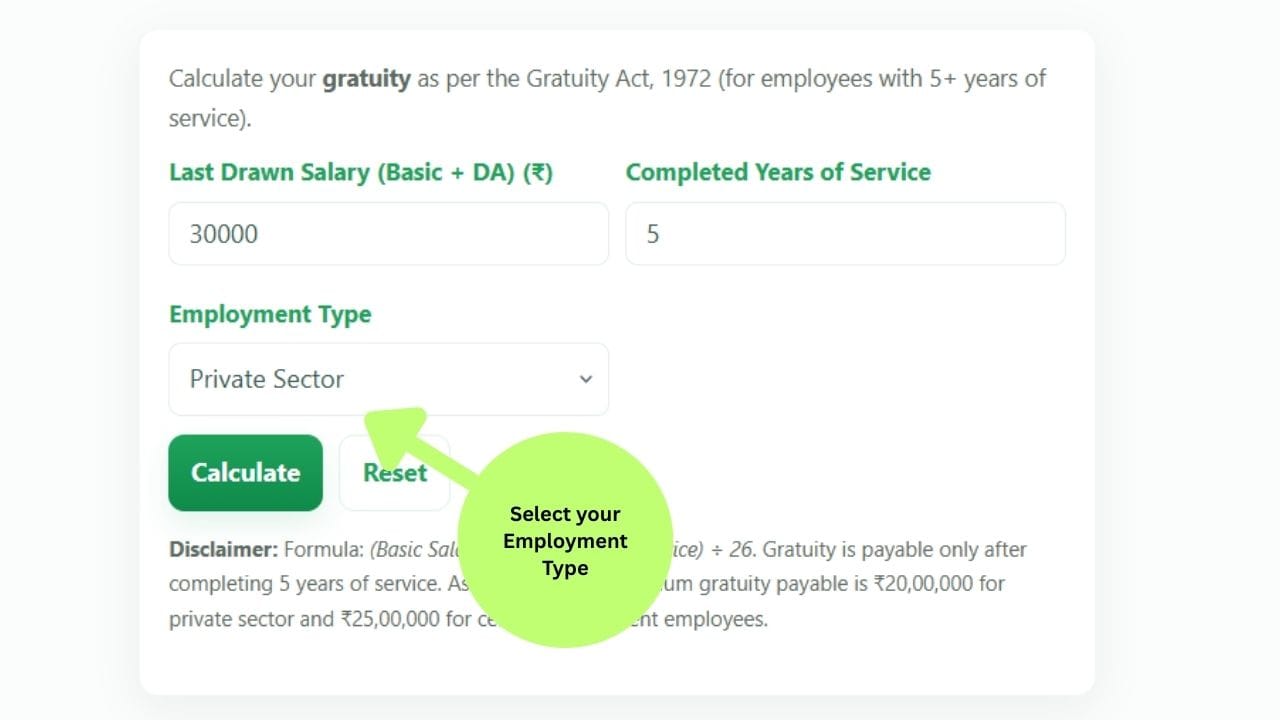

Instead of calculating manually, you can use an online gratuity calculator. Simply enter:

- Last drawn basic salary + DA

- Total years of completed service

- Select your employment type.

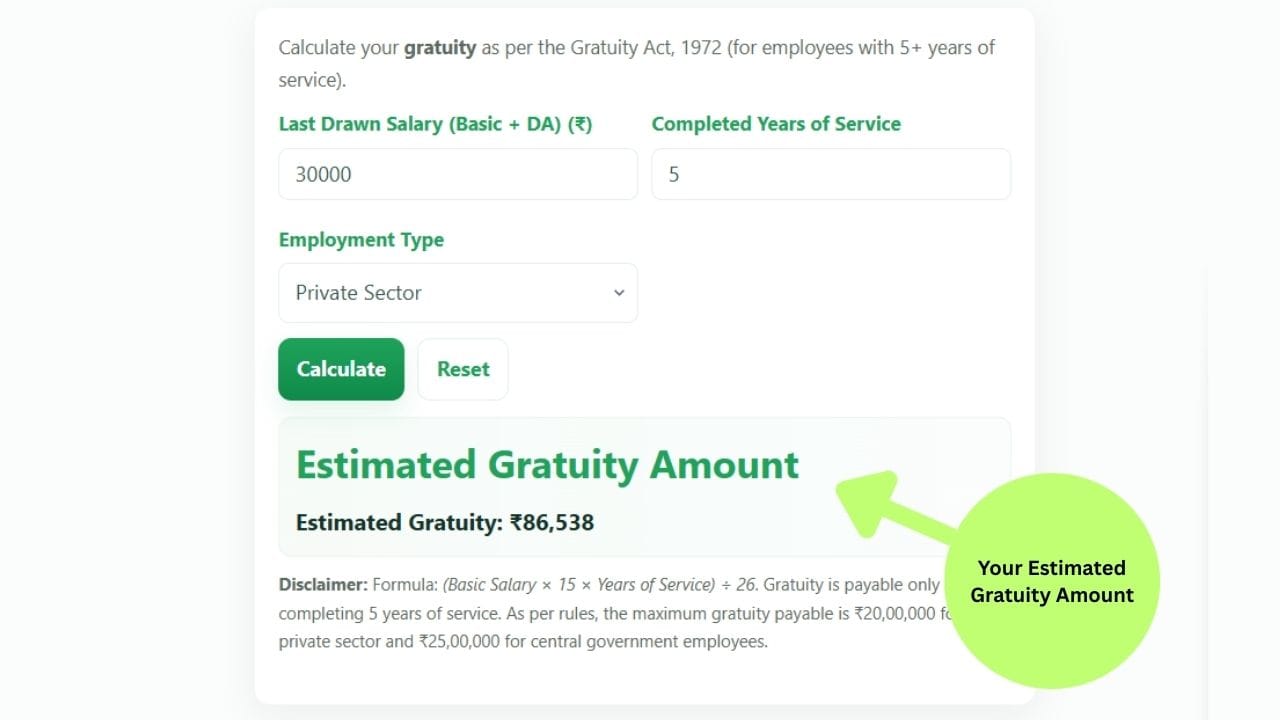

The calculator will instantly display your estimated gratuity amount, applying the formula and maximum limits

Step-by-Step Guide to Using a Gratuity Calculator

- Enter your last drawn basic salary + DA.

- Enter your total years of service.

- Select your employment type.

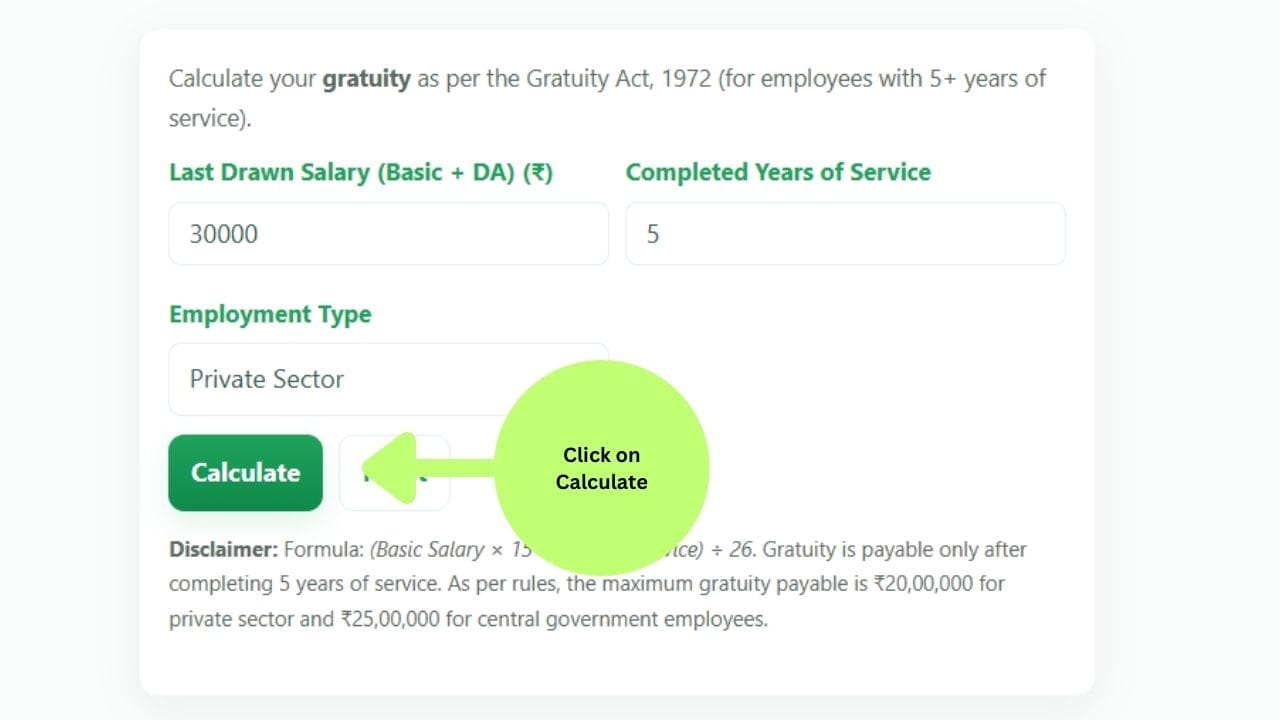

- Click on calculate.

- Instantly view the gratuity amount you are eligible for.

Gratuity Calculation Examples

Example 1:

Salary: ₹40,000 (Basic + DA)

Years of Service: 10 years

Gratuity = (40,000 × 15 × 10) ÷ 26 = ₹2,30,769

Example 2:

Salary: ₹25,000 (Basic + DA)

Years of Service: 6 years 7 months (rounded up to 7 years)

Gratuity = (25,000 × 15 × 7) ÷ 26 = ₹1,01,442

Gratuity Rules under the Payment of Gratuity Act, 1972

- Applicable to companies with 10 or more employees.

- The maximum gratuity limit is ₹20 lakh for private sector employees and ₹25 lakh for central government employees (as per the latest rules).

- Employers cannot refuse gratuity if eligibility conditions are met.

Maximum Gratuity Limit in India

As per the latest rules:

- Private Sector Employees → Maximum gratuity payable is ₹20,00,000

- Central Government Employees → Maximum gratuity payable is ₹25,00,000

Even if your calculation exceeds this limit, the employer is not liable to pay more than the prescribed maximum.

Tax Implications on Gratuity

- For government employees: Gratuity is fully tax-free.

- For private employees: Exempt up to ₹20 lakh; anything above is taxable.

Gratuity for Government vs. Private Employees

- Government employees: 100% gratuity, no tax.

- Private employees: Subject to conditions and tax exemptions.

What Happens if an Employee Dies or Becomes Disabled?

In such cases, gratuity is paid to the nominee or legal heir, even if the employee has not completed 5 years of service.

Common Misconceptions about Gratuity

- Myth: Gratuity is given only at retirement.

- Fact: It is also payable on resignation after 5 years.

- Myth: All allowances are included.

- Fact: Only basic salary + DA is considered.

Conclusion

To sum up, gratuity is not just a legal benefit—it’s a financial reward for your loyalty and service. Using a Gratuity Calculator makes it simple to know how much you’re entitled to, helping you plan your future with confidence.

So, the next time someone asks, “How much gratuity will I get?”, you’ll have the perfect answer—just use a Gratuity Calculator!

In short, gratuity serves as a retirement benefit that ensures financial security for employees after leaving an organization.

Frequently Asked Questions (FAQ) – Gratuity Calculator

Q1. Can I claim gratuity if I resign before 5 years?

No, gratuity is only payable after completing 5 years of continuous service, except in cases of death or disability.

Q2. Is gratuity part of my CTC?

Yes, many employers include the estimated gratuity liability in their overall CTC (Cost to Company).

Q3. Is gratuity taxable?

Yes, but it is exempt up to ₹20 lakh (private sector) and ₹25 lakh (government employees).

Q4. Do contract employees receive gratuity?

Yes, if they are employed directly by the organization and have completed 5 years of continuous service.